Recap for December 18

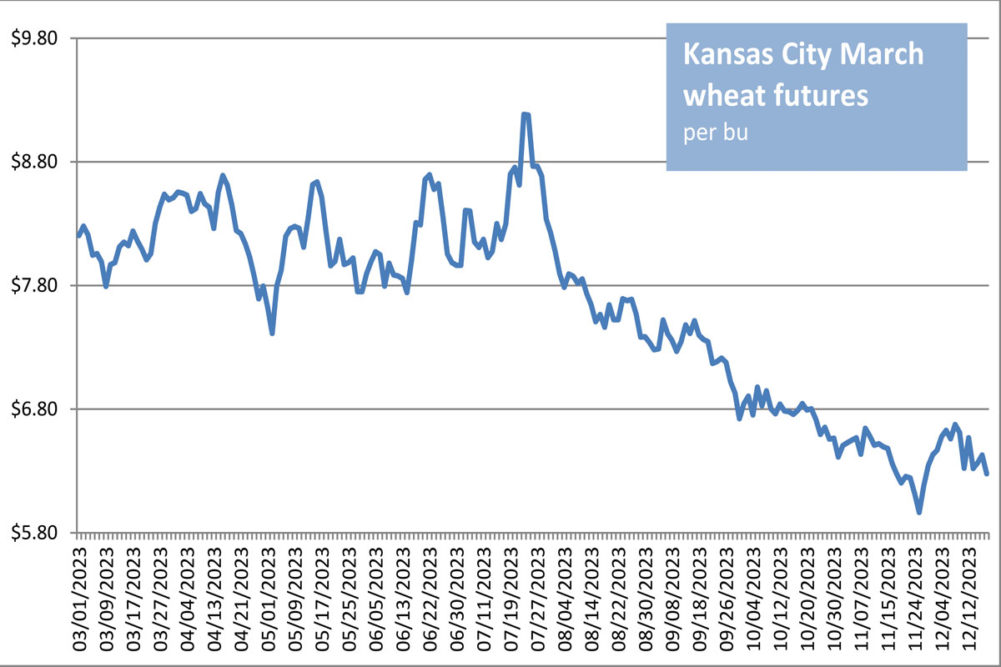

- US soy complex futures were initially lower but rallied and posted a daily gain on good export demand, including a proposed export tax increase on soy products by Argentina. Technical selling weighed on corn and wheat futures, the latter also pressured by plentiful, inexpensive Russian wheat that was expected to supply a substantial portion of Saudi Arabia’s 1.35-million-tonne purchase over the weekend. March corn futures dipped 6¢ to close at $4.77 per bu, but later months were mixed. Chicago March wheat pared 12¼¢ to close at $6.17 per bu. Kansas City March wheat fell 15¢ to close at $6.27¾ per bu. Minneapolis March wheat was down 9¼¢ to close at $7.21½ per bu. January soybeans added 11¼¢ to close at $13.27 per bu. January soybean meal was up $7.20 to close at $412.80 per ton. January soybean oil added 0.65¢ to close at 50.64¢ a lb.

- US stock prices continued to rally Monday, the S&P 500 coming off of a seventh consecutive week of gains, on investor confidence the US central bank will machinate a “soft landing,” returning inflation to its 2% target while avoiding a recession. The Dow Jones Industrial Average edged up 0.86 point to close at 37,306.02. The Standard & Poor’s 500 added 21.37 points, or 0.45%, to close at 4,740.56. The Nasdaq Composite was up 90.89 points, or 0.61%, to close at 14,904.81.

- US crude oil prices advanced Monday. The January West Texas Intermediate light, sweet crude future was up $1.04 to close at $72.47 per barrel.

- The US dollar index declined Monday as it did most days the previous week.

- US gold futures were higher Monday. The February contract added $4.80 to close at $2,040.50 per oz.

Recap for December 15

- Soybean futures edged higher in the prompt contract but slipped thereafter as traders monitored forecasts for beneficial rain in dry areas of Brazil, where crop losses due to weather could boost export demand for US soybeans. Wheat futures closed higher in technical buying with many in the trade watching for signals of more soft wheat sales to China. Spillover support from wheat futures, along with technical buying, helped pull corn futures higher to close the week. March corn futures added 3¾¢ to close at $4.83 per bu. Chicago March wheat added 13½¢ to close at $6.29¼ per bu. Kansas City March wheat advanced 6¼¢ to close at $6.42¾ per bu. Minneapolis March wheat was up 13½¢ to close at $7.30¾ per bu. January soybeans added 1¾¢ to close at $13.15¾ per bu, though all later months were lower. January soybean meal was up $1.90 to close at $405.60 per ton; the May contract and beyond slipped lower. January soybean oil added 0.48¢ to close at 49.99¢ a lb.

- US equity markets were mixed Friday with the S&P 500 slipping lower, although the broad index posted a seventh consecutive weekly gain. The three major indexes were up more than 2% for the week after the Federal Reserve hinted Wednesday it could sharply cut interest rates next year, which would mark a major turning point in the Fed’s roughly two-year campaign to control inflation. The Dow Jones Industrial Average gained 56.81 points, or 0.15%, to close at 37,305.16, the third fresh all-time record-high this week. The Standard & Poor’s 500 eased 0.36 point, or 0.01%, to close at 4,719.19. The Nasdaq Composite was up 52.36 points, or 0.19%, to close at 14,813.92.

- US crude oil prices declined Friday. The January West Texas Intermediate light, sweet crude future was down 15¢ to close at $71.43 per barrel.

- The US dollar index closed the week on an upswing after weakening the previous three trading days.

- US gold futures were lower Friday. The February contract shed $9.20 to close at $2,035.70 per oz.

Recap for December 14

- US equity markets closed higher Thursday for a second day of a rally sparked by the Federal Reserve bank’s decision to leave interest rates untouched for now and indications their aggressive inflation fighting measures may start to pull back early next year. The week’s advances have been deemed an “everything rally” on the broad base of company shares rising, but some market analysts caution investors may be pricing in steeper interest rate cuts in 2024 than the Fed has forecast. The Dow Jones Industrial Average gained 158.11 points, or 0.43%, higher to close at 37,248.35, the second fresh all-time record-high this week. The Standard & Poor’s 500 advanced 12.46 points, or 0.26%, to close at 4,719.55. The Nasdaq Composite was up 27.59 points, or 0.19%, to close at 14,761.56.

- Steady export demand for US supplies as the dollar continued to weaken sent soybean futures higher Thursday. The dollar’s weakness and technical buying sent wheat futures higher. And corn futures were nearly flat in choppy, directionless trading before closing narrowly mixed. March corn futures eased ¼¢ to close at $4.79¼ per bu with later months narrowly mixed. Chicago March wheat added 10½¢ to close at $6.15¾ per bu. Kansas City March wheat advanced 4½¢ to close at $6.36½ per bu. Minneapolis March wheat was up 3¾¢ to close at $7.17¼ per bu. January soybeans added 6½¢ to close at $13.14 per bu. January soybean meal was up $1.50 to close at $403.70 per ton. January soybean oil shaved 0.32¢ to close at 49.51¢ a lb with furthest deferred contracts edging higher.

- US crude oil prices advanced again Thursday. The January West Texas Intermediate light, sweet crude future was up $2.11 to close at $71.58 per barrel.

- The US dollar index declined for a third day Thursday following a two-session upswing Dec. 8 and 11.

- US gold futures were higher Thursday. The February contract added $47.60 to close at $2,044.90.30 per oz.

Recap for December 13

- US equity markets hewed close to flat most of the day Wednesday until the Federal Reserve announced it would hold interest rate steady and perhaps would begin easing monetary policy next year. The resulting buying frenzy sent the Dow industrials average above 37,000 points for the first time in history. The Dow Jones Industrial Average soared 512.30 points, or 1.4%, higher to close at 37,090.24, a fresh record high. The Standard & Poor’s 500 advanced 63.39 points, or 1.37%, to close at 4,707.09. The Nasdaq Composite jumped 200.57 points, or 1.38%, to close at 14,733.96.

- Rainy Brazilian forecasts sent soybean futures lower Wednesday. Wheat futures were lower in profit taking in the wake of four-month highs. Corn futures posted their lowest closes since Nov. 29. March corn futures fell 5¾¢ to close at $4.79½ per bu. Chicago March wheat dropped 20¼¢ to close at $6.05¼ per bu. Kansas City March wheat tumbled 24¾¢ to close at $6.32 per bu. Minneapolis March wheat fell 16¢ to close at $7.13½ per bu. January soybeans subtracted 16¼¢ to close at $13.07½ per bu. January soybean meal was down $8.10 to close at $402.20 per ton. January soybean oil pared 0.59¢ to close at 49.83¢ a lb.

- US crude oil prices advanced Wednesday. The January West Texas Intermediate light, sweet crude future was up 86¢ to close at $69.47 per barrel.

- The US dollar index declined for a second day Wednesday after rising in the sessions bookending the weekend.

- US gold futures were higher Wednesday. The January contract added $4.50 to close at $1,982.30 per oz.

Recap for December 12

- Wheat complex futures soared Tuesday on short covering and signs of international demand. Soybean futures declined after touching December highs as traders monitored weather forecasts in top competitor Brazil. Corn futures were higher in short covering. December corn futures added 2¢ to close at $4.62½ per bu; later months were mixed. Chicago December wheat added 15¾¢ to close at $6.07 per bu. Kansas City December wheat jumped 24½¢ to close at $6.51½ per bu. Minneapolis December wheat fell 12½¢ to close at $7.00¼ per bu; later months were higher. January soybeans dropped 12¼¢ to close at $13.23¾ per bu. December soybean meal was down $1.50 to close at $429.20 per ton. December soybean oil fell 0.67¢ to close at 50.39¢ a lb.

- US equity markets closed higher after a report said the Consumer Price Index rose 3.1% in November from a year prior, a slight pullback from October and in line with economists’ expectations. Prices increased 0.1% from the prior month, stronger than the steady reading economists had projected. The Dow Jones Industrial Average added 173.01 points, or 0.48%, to close at 36,577.94. The Standard & Poor’s 500 advanced 21.26 points, or 0.46%, to close at 4,643.70. The Nasdaq Composite jumped 100.91 points, or 0.70%, to close at 14,533.40.

- US crude oil prices declined Tuesday. The January West Texas Intermediate light, sweet crude future was down $2.71 to close at $68.61 per barrel.

- The US dollar index declined Tuesday after rising the two previous sessions.

- US gold futures were lower Tuesday. The December contract shed 20¢ to close at $1977.80 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |

link